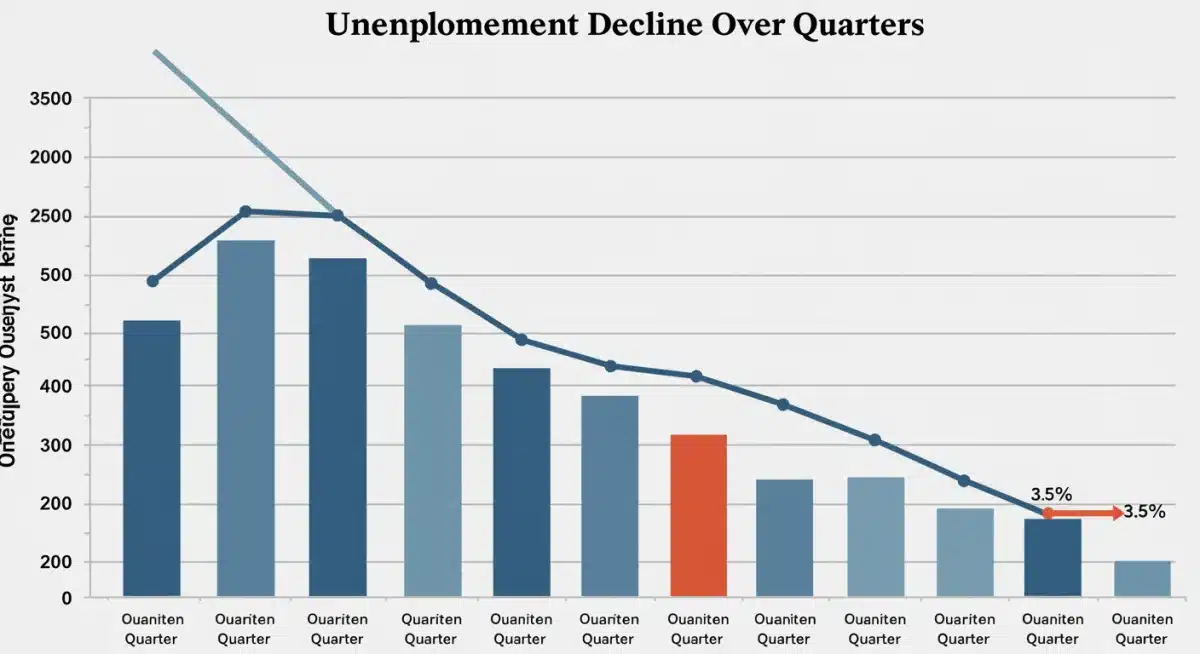

Unemployment Figures Update: National Rate Drops to 3.5% in Q4 Report

Anúncios

The national unemployment rate dropped to 3.5% in the recent Q4 report, reflecting a robust labor market and positive economic indicators across the United States.

Anúncios

The latest economic data brings welcome news for the American workforce: the unemployment national rate has seen a significant drop, settling at 3.5% in the recent Q4 report. This figure not only reflects a resilient labor market but also offers a clearer picture of the nation’s economic health as we move forward. Understanding the nuances behind this number is crucial for businesses, policymakers, and individuals alike.

Understanding the Q4 Unemployment Drop

The fourth quarter of the year often provides a comprehensive look at annual economic trends, and this period’s unemployment figures are particularly noteworthy. A drop to 3.5% signifies a tightening labor market, where job opportunities are more abundant and fewer people are actively seeking employment.

Anúncios

This decline is not just a statistical anomaly; it is the result of various economic forces converging. From increased consumer spending to strategic business investments, multiple factors contribute to a healthier job landscape. Analyzing these elements helps us appreciate the full scope of this positive development.

Key Factors Driving the Decline

- Strong Business Growth: Many sectors experienced expansion, leading to increased hiring.

- Seasonal Employment: The holiday season often boosts temporary job creation, influencing Q4 numbers.

- Government Policies: Certain fiscal incentives and economic policies may have stimulated job growth.

- Worker Mobility: Improved conditions encouraged workers to transition into new roles, reducing long-term unemployment.

The reduction in the national unemployment rate to 3.5% is a strong indicator of economic stability and growth. It suggests that businesses are confident enough to expand their workforces, and individuals are finding it easier to secure employment. This positive trend has wider implications for wage growth, consumer confidence, and overall economic prosperity, setting a hopeful tone for the upcoming year.

Analyzing the Impact on the US Labor Market

A 3.5% unemployment rate significantly reshapes the dynamics of the US labor market. This low figure indicates that employers are likely facing a more competitive environment for talent, potentially leading to higher wages and improved benefits packages to attract and retain skilled workers. For job seekers, this translates into more leverage and a wider array of choices.

The impact extends beyond mere numbers; it influences career trajectories and economic well-being across various demographics. Understanding how different sectors respond to this tight labor market is essential for both businesses and individuals planning their future.

Sector-Specific Job Growth

While the national rate is a broad indicator, specific industries have shown remarkable growth, contributing significantly to the overall decline. The technology sector, healthcare, and logistics continue to be major drivers of job creation. This targeted growth highlights evolving economic priorities and demands.

The services industry, particularly hospitality and retail, also saw substantial gains, reflecting a resurgence in consumer activity. These sectors, often sensitive to economic shifts, are now robust contributors to employment, underscoring a broad-based recovery.

- Technology: Continued demand for innovation and digital transformation.

- Healthcare: Aging population and advancements in medical science drive expansion.

- Logistics: E-commerce boom necessitates more efficient supply chains.

- Hospitality & Retail: Increased consumer confidence fuels spending and staffing needs.

This low unemployment rate creates a virtuous cycle where increased employment leads to higher consumer spending, which in turn stimulates further job creation. However, it also presents challenges, such as potential wage inflation and a shortage of specialized skills. Balancing these factors will be key to sustainable economic growth.

Regional Variations in Employment Trends

While the national figure of 3.5% offers a general overview, it’s crucial to acknowledge that employment trends can vary significantly across different regions of the United States. Economic landscapes are diverse, influenced by local industries, demographic shifts, and specific state-level policies. A deep dive into regional data provides a more granular understanding of where job growth is strongest and where challenges might still persist.

Some states and metropolitan areas have experienced even lower unemployment rates, reflecting thriving local economies and robust job markets. Conversely, other regions might still be grappling with slower recovery or structural unemployment challenges. These disparities highlight the complex nature of economic recovery and the importance of localized policy interventions.

For instance, states with strong technology hubs or booming manufacturing sectors often outperform the national average. Similarly, areas heavily reliant on industries facing automation or global competition might see slower progress. Understanding these regional nuances is vital for accurate economic forecasting and targeted support.

States Leading the Job Recovery

- Texas: Driven by energy, tech, and manufacturing sectors.

- Florida: Tourism and population growth fueling diverse job creation.

- Arizona: Attracting new businesses and residents, particularly in tech and healthcare.

- North Carolina: Strong in research, technology, and advanced manufacturing.

These regional differences underscore the fact that economic health is not uniformly distributed. While the national picture is positive, policymakers and community leaders must remain attentive to the specific needs and opportunities within their local economies. Tailored strategies are often more effective in addressing localized employment issues and fostering inclusive growth across the nation.

Economic Implications of a Tight Labor Market

A national unemployment rate of 3.5% signals a tight labor market, a condition with profound economic implications that extend far beyond just employment numbers. This scenario typically means that the supply of available workers is low relative to the demand from employers. Consequently, businesses often find themselves competing more aggressively for talent, which can lead to a series of ripple effects throughout the economy.

One of the most immediate consequences is upward pressure on wages. As companies vie for a limited pool of skilled workers, they are often compelled to offer higher salaries and more attractive benefits packages. While beneficial for employees, this can also translate into increased operational costs for businesses, potentially affecting their pricing strategies and profitability. Understanding these dynamics is crucial for businesses navigating this economic climate.

Potential Economic Outcomes

- Wage Growth: Increased competition for labor often drives up average wages.

- Inflationary Pressures: Higher labor costs can be passed on to consumers through increased prices.

- Productivity Challenges: Businesses might struggle to find qualified staff, potentially impacting output.

- Innovation Incentives: Companies may invest more in automation and technology to offset labor shortages.

Furthermore, a tight labor market can spur innovation as businesses seek ways to become more efficient and less reliant on manual labor. This might involve adopting new technologies, streamlining processes, or investing in employee training and development to enhance productivity. However, there’s also the risk of ‘wage-price spirals’ where rising wages lead to higher prices, which then fuel demands for even higher wages, potentially contributing to inflation. Monitoring these economic indicators closely will be vital for maintaining stability.

Challenges and Opportunities for Job Seekers

For job seekers, a national unemployment rate of 3.5% presents a landscape filled with both exciting opportunities and unique challenges. On the one hand, a robust job market means more open positions, potentially quicker hiring processes, and a stronger bargaining position for candidates. This is particularly true for those with in-demand skills and experience, who may find themselves courted by multiple employers.

However, a tight labor market doesn’t automatically guarantee an easy job search for everyone. While there are more jobs, the competition for highly coveted roles remains fierce. Furthermore, certain industries or roles might still face skill gaps, meaning that even with low unemployment, employers might struggle to find candidates with the precise qualifications they need. This dynamic highlights the importance of continuous learning and adaptability for job seekers.

Navigating the Competitive Landscape

To capitalize on the current market, job seekers should focus on enhancing their skill sets and tailoring their applications. Networking becomes even more critical, as many opportunities are filled through referrals. Highlighting unique qualifications and demonstrating a willingness to learn new technologies can provide a significant edge.

Moreover, understanding current wage trends and benefits expectations can help job seekers negotiate more effectively. The current environment empowers candidates to seek not just a job, but a role that aligns with their career aspirations and provides fair compensation. This shift in power dynamics can lead to more fulfilling employment experiences.

- Skill Enhancement: Investing in new certifications or vocational training.

- Tailored Applications: Customizing resumes and cover letters for each specific role.

- Networking: Leveraging professional connections and attending industry events.

- Negotiation Skills: Preparing to discuss salary, benefits, and work-life balance.

Ultimately, a 3.5% unemployment rate creates a favorable environment for job seekers, but success still hinges on proactive engagement and strategic positioning. Those who continuously adapt and invest in their professional development are best placed to thrive in this dynamic labor market.

Looking Ahead: Future Economic Projections

With the national unemployment rate at 3.5%, the focus now shifts to future economic projections and how this low figure might influence upcoming trends. Economic forecasts suggest a period of continued stability, but not without potential headwinds. Understanding these future dynamics is crucial for businesses and individuals making long-term plans, from investment strategies to career development.

Analysts are closely watching indicators such as inflation, interest rates, and global economic stability, all of which can impact the labor market. While a low unemployment rate is generally positive, sustained low rates can sometimes lead to overheating in the economy, prompting central banks to implement measures to cool growth. This delicate balance requires careful monitoring and adaptive strategies.

Key Areas for Future Observation

Several factors will play a critical role in shaping the labor market and broader economy in the coming quarters. The ongoing evolution of technology, particularly in automation and artificial intelligence, will continue to reshape job roles and demand for specific skills. Geopolitical events also have the potential to influence supply chains and consumer confidence, indirectly affecting employment.

Furthermore, government fiscal and monetary policies will be instrumental in guiding economic stability. Decisions regarding spending, taxation, and interest rates can either stimulate or temper economic growth, directly impacting job creation and unemployment figures. The interplay of these complex factors will define the future economic landscape.

- Technological Advancements: AI and automation’s impact on job structures.

- Inflation Trends: How rising prices affect purchasing power and demand.

- Interest Rate Decisions: Central bank policies influencing borrowing and investment.

- Global Economic Health: International trade and geopolitical stability effects.

The current low unemployment rate provides a strong foundation, but proactive planning and adaptability will be essential to navigate the evolving economic environment. Businesses should focus on resilience and innovation, while individuals should prioritize continuous learning to remain competitive in a dynamic job market. The future, while promising, demands vigilance and strategic foresight.

| Key Point | Brief Description |

|---|---|

| National Rate Drop | Unemployment fell to 3.5% in Q4, indicating a robust and tightening labor market. |

| Economic Impact | Low unemployment typically leads to wage growth but can also create inflationary pressures. |

| Job Seeker Outlook | More opportunities and stronger negotiation power for skilled workers. |

| Future Projections | Continued stability expected, but vigilance needed for inflation and global factors. |

Frequently Asked Questions About Unemployment Figures

A 3.5% unemployment rate indicates a very tight labor market, meaning there are more job openings than available workers. This generally signals a strong economy, often leading to wage growth and increased consumer spending. It suggests that most individuals who want to work can find employment.

The unemployment rate is calculated as the percentage of the total labor force that is unemployed but actively seeking employment. It excludes individuals who are not looking for work, such as retirees or full-time students. The data is typically collected through surveys by government agencies.

While specific data varies, Q4 generally saw significant job growth in sectors like technology, healthcare, logistics, and hospitality. These industries often benefit from increased consumer demand, seasonal hiring, and ongoing technological advancements, contributing substantially to the overall drop in unemployment.

While generally positive, extremely low unemployment rates can sometimes lead to challenges such as labor shortages and inflationary pressures. Businesses may face higher labor costs, which can be passed on to consumers, potentially impacting overall economic stability if not managed carefully by monetary policy.

A low unemployment rate, especially if coupled with wage growth, can signal potential inflationary pressures to central banks. This might prompt them to consider raising interest rates to cool down the economy and prevent overheating. However, other economic factors are also considered in such decisions.

Conclusion

The recent Q4 report, highlighting a national unemployment rate drop to 3.5%, paints a largely positive picture of the US economy. This significant decrease underscores a resilient labor market, offering expanded opportunities for job seekers and signaling confidence among businesses. While the overall outlook is optimistic, understanding the regional variations and potential economic implications, such as wage growth and inflationary pressures, remains crucial. As we move forward, continuous monitoring of these trends and adaptive strategies will be key to sustaining economic health and fostering inclusive growth across the nation.