Social Security benefit calculation 2025: what you need to know

Anúncios

To navigate the Social Security benefits application process, gather necessary documents, apply online or in person, ensure accuracy, and expect a processing time of 3 to 6 months for your application.

Social Security benefit calculation 2025 plays a vital role in your financial future. Have you ever wondered how the adjustments for inflation impact the benefits you receive? Let’s dive into the important factors that influence these calculations.

Anúncios

Understanding the basics of Social Security benefits

Understanding the basics of Social Security benefits is essential for anyone planning for retirement. These benefits can play a crucial role in your financial security. In this section, we will explore the fundamental aspects of Social Security and its calculations.

What are Social Security benefits?

Social Security benefits are payments made to individuals based on their earnings history. These payments help provide financial support when someone retires, becomes disabled, or passes away. The amount you receive is determined by your average lifetime earnings and the age at which you decide to start receiving benefits.

Anúncios

How benefits are calculated

The calculation of your Social Security benefits involves several critical steps:

- Your income history: This includes all the years you worked and paid into the system.

- The average indexed monthly earnings (AIME) is calculated, which considers your highest-earning years.

- The primary insurance amount (PIA) is derived from AIME, determining your benefits at full retirement age.

It’s important to note that you can begin receiving Social Security benefits as early as age 62, but the benefits will be reduced compared to waiting until your full retirement age.

Many people wonder when the best time to claim their benefits is. The decision can significantly affect your overall lifetime benefits. Generally, waiting until your full retirement age or beyond can lead to larger monthly payments. However, personal circumstances can dictate the best time to file.

Impact of inflation on benefits

Inflation plays a significant role in Social Security benefits. Each year, the Social Security Administration adjusts the benefits for inflation through what is known as the Cost of Living Adjustment (COLA). This helps ensure that your purchasing power remains stable as prices rise over time. The adjustments are typically based on the Consumer Price Index (CPI).

As you consider your future and the impact of these benefits on your retirement plans, keeping informed about how these calculations work can empower you to make the best decisions for your financial future.

Factors affecting benefit calculation for 2025

Numerous factors influence how your Social Security benefits will be calculated for 2025. Understanding these elements can help you maximize your benefits and make informed financial decisions.

Income History

Your income history is one of the most significant contributors to your benefit calculation. The Social Security Administration (SSA) looks at your 35 highest-earning years. If you work less than 35 years, zeros are added to the calculation, which can lower your monthly benefits significantly.

Retirement Age

When you choose to retire also impacts your benefits. If you claim benefits early, typically at age 62, your monthly amount will be reduced. Waiting until your full retirement age can enhance your benefits.

- If you retire at 62, you could lose up to 30% of your benefits.

- Delaying benefits past full retirement age can increase them by up to 8% each year until age 70.

- Understanding your personal financial situation is key to choosing the right time to apply for benefits.

Another important consideration is your age at the time of claiming. The decisions you make can have lifelong effects on your financial stability in retirement. Factors such as health status and life expectancy should also be evaluated when deciding when to claim.

Cost of Living Adjustments (COLA)

The SSA also makes adjustments to benefits based on inflation through Cost of Living Adjustments (COLA). In 2025, these adjustments will ensure that your benefits keep pace with rising prices. The amount of the COLA is determined by changes in the Consumer Price Index (CPI).

COLA ensures that your retirement income does not lose purchasing power over time. This keeps you financially secure, despite fluctuations in the economy.

Being aware of these factors will not only help you understand how your Social Security benefits are calculated but also empower you to make better decisions regarding your retirement planning.

Key strategies to maximize your Social Security benefits

Maximizing your Social Security benefits is essential for securing a comfortable retirement. Implementing effective strategies can lead to significant financial advantages. Knowing how to optimize these benefits will make a big difference in your financial future.

Understand Your Full Retirement Age

Your full retirement age is a crucial factor in maximizing benefits. Depending on your birth year, your full retirement age ranges from 66 to 67. Retiring before this age may decrease your monthly benefit.

Delay Claiming Benefits

One of the best strategies is to delay claiming your benefits as long as possible. For every year you wait past your full retirement age, your benefit amount increases by about 8%. This can significantly boost your monthly income.

- If you start benefits at age 62, you may lose up to 30% of your benefits compared to waiting.

- Waiting until age 70 can lead to the maximum benefit possible.

- Consider your health and life expectancy when deciding when to claim.

Another effective strategy includes enhancing your income history by working more years. More working years can raise your average indexed monthly earnings (AIME). Even part-time work can help increase your overall benefits significantly.

Coordinate with Your Spouse

If you’re married, it’s beneficial to coordinate your claiming strategies with your spouse. Depending on your earnings history, one may be eligible for spousal benefits that can increase your total monthly income. Analyzing both of your benefits can help determine the best claiming strategy.

Lastly, keeping track of any changes to your benefits is essential. Social Security regulations may change, and being proactive can ensure you’re always well-informed.

By taking these steps, you can maximize your Social Security benefits and ensure a more secure financial future for yourself in retirement.

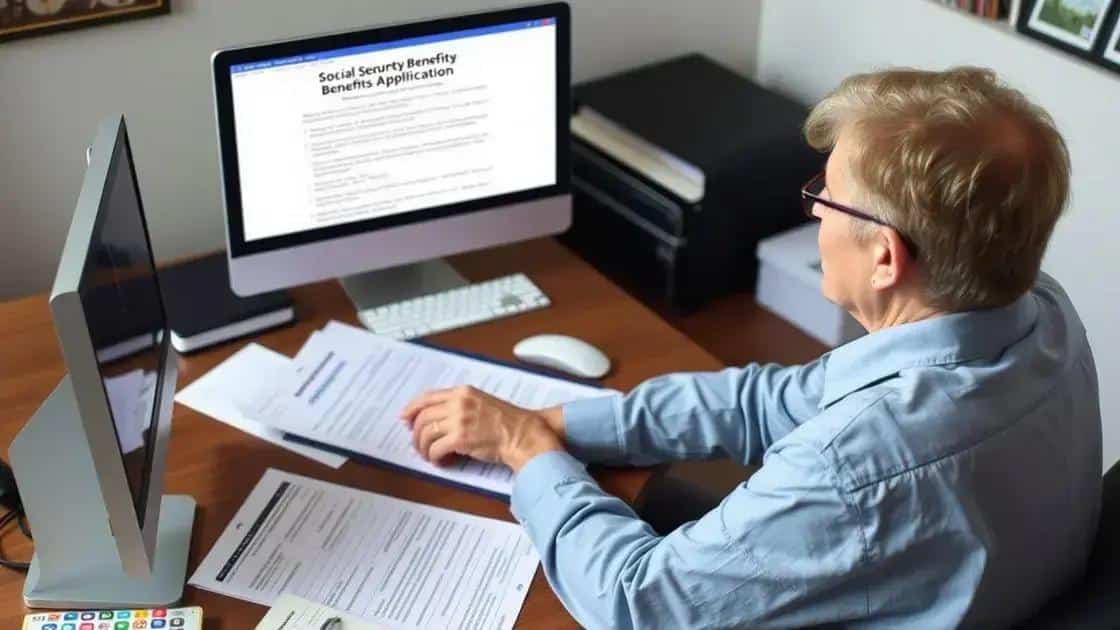

Navigating the application process for Social Security benefits

Navigating the application process for Social Security benefits can seem intimidating, but understanding the steps involved can simplify everything. Knowing what to expect will help you avoid common pitfalls and ensure you complete your application correctly.

Gather Necessary Documents

Before starting your application, it is crucial to gather the required documents. This may include your Social Security number, birth certificate, and proof of income. Having everything ready will make the process smoother.

Online vs. In-Person Applications

You can apply for Social Security benefits online, by phone, or in person. Online applications are often the quickest and most convenient method. If you prefer speaking to someone directly, you can call the SSA or visit a local office.

- Applying online is available for most individuals.

- Call their toll-free number for assistance or to set up an appointment.

- In-person visits may require scheduling ahead of time.

When filling out your application, accuracy is key. Ensure all information is correct and complete. Incomplete applications can lead to delays or denials.

Understand the Timeline

The processing time for Social Security applications can vary. Generally, it takes three to six months to receive a decision. While waiting, check your application status online or by phone to stay updated.

Once approved, your Social Security benefits will start based on the date specified in your application. Be sure to keep track of any notifications or requests for additional information from the SSA during the processing period.

By preparing in advance and understanding the application steps, you can navigate the Social Security benefits process with confidence.

FAQ – Frequently Asked Questions about Navigating Social Security Benefits

What documents do I need to apply for Social Security benefits?

You will need your Social Security number, birth certificate, and proof of income.

Can I apply for Social Security benefits online?

Yes, applying online is the quickest and most convenient method to submit your application.

How long does it take to process my Social Security application?

Typically, it takes between 3 to 6 months to receive a decision on your application.

What should I do if my application is delayed?

If your application is delayed, you can check its status online or call the Social Security Administration for updates.