Social security benefits: what you need to know

Anúncios

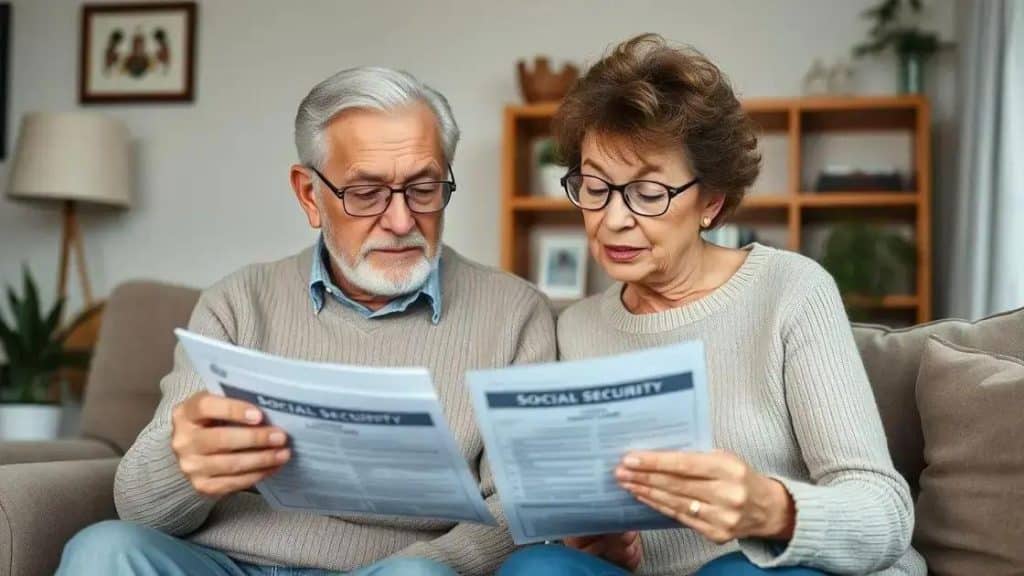

Social security benefits include retirement, disability, and survivor assistance, and eligibility depends on your work history, age, and compliance with specific requirements.

Social security benefits play a crucial role in ensuring financial stability for many individuals. Have you ever wondered how these benefits might affect your future? Let’s dive into the essentials that can help you navigate this important aspect of life.

Anúncios

Understanding social security benefits

Understanding social security benefits is essential to planning for your future. These benefits provide a vital safety net for millions of Americans, helping with expenses and ensuring a stable income during retirement.

What Are Social Security Benefits?

Social security benefits are monthly payments made to eligible individuals. They can assist those who are retired, disabled, or survivors of deceased workers. The amount you receive generally depends on your work history and the amount you contributed to the social security system while working.

Anúncios

Types of Social Security Benefits

- Retirement Benefits: Paid to individuals once they reach retirement age.

- Disability Benefits: For those who cannot work due to a disability.

- Survivor Benefits: Help family members after the death of a worker.

When considering social security, it’s important to understand how these benefits are calculated. Your benefits are determined by your lifetime earnings, the age at which you decide to begin receiving benefits, and your work history. Generally, the longer you work and the more you earn, the higher your potential benefits can be.

Many people often overlook potential benefits available to them. For example, not only can individuals receive retirement benefits, but they may also qualify for other programs such as Supplemental Security Income (SSI) if they meet certain criteria. Researching these avenues can ensure you maximize your financial support.

It’s crucial to plan ahead and understand your options. Knowing how to navigate your social security benefits can save you from potential financial stress later in life. Consider speaking with a financial advisor or using the Social Security Administration’s online tools to get an estimate of your benefits.

Eligibility requirements for social security

Understanding the eligibility requirements for social security is crucial for anyone planning to apply for these benefits. There are several factors that determine whether you qualify, and knowing them can help you plan effectively.

Basic Eligibility Criteria

To be eligible for social security benefits, you generally must have worked for a certain number of years and paid social security taxes. Typically, you need to earn at least 40 work credits, which equates to about 10 years of work. However, younger individuals may qualify with fewer credits if they become disabled.

Age Requirements

- You must be at least 62 years old to start receiving retirement benefits.

- If you are applying for disability benefits, there is no specific age requirement.

- The full retirement age varies based on your birth year, ranging from 66 to 67 years.

In addition to age, citizenship and residency are also considered. You must be a U.S. citizen or a legal resident and have lived in the U.S. for a minimum period to qualify. It’s essential to maintain your resident status during the application process to avoid complications.

Some eligibility aspects differ depending on the type of benefit. For example, survivor benefits may be accessible to family members of deceased workers, while disability benefits focus on your current ability to work. It’s important to gather all relevant documents that prove your work history and current situation.

Before you apply, make sure to check your eligibility status using the Social Security Administration’s online tools. This can help you clarify any uncertainties and streamline the application process.

How to apply for social security benefits

Applying for social security benefits can seem daunting, but understanding the process simplifies it significantly. The application steps are straightforward and can set you on a path to receiving the benefits you deserve.

Gather Necessary Information

Before starting your application, collect essential documents. These include your Social Security number, proof of age, work history, and any relevant medical documentation. Having these items organized will help you complete your application efficiently.

Online Application Process

- Visit the Social Security Administration (SSA) website.

- Click on the “Apply for Benefits” section.

- Follow the prompts to enter your information accurately.

The online process allows you to apply at your convenience without the need for an appointment. It’s a quick way to get started on your application from the comfort of your home.

If you prefer a face-to-face interaction, you can schedule an appointment at your local Social Security office. During this appointment, a representative will guide you through the application process and answer any questions you may have.

After submitting your application, it’s important to keep track of its status. You can do this online or by contacting the SSA directly. If additional information is needed, they will inform you of any requirements.

Remember to keep copies of all documents you submit. This can help you address any issues that may arise and keep your application on track. Applying for social security benefits doesn’t have to be stressful; understanding the steps involved makes the process smoother.

Common misconceptions about social security

There are many common misconceptions about social security that can lead to confusion and misinformation. Understanding the truth behind these myths is essential for making informed decisions regarding your benefits.

Myth: You Can’t Work and Receive Benefits

Many believe that if you begin to receive social security benefits, you cannot work at all. This is not true. You can earn a certain amount of income while receiving benefits. However, there are limits on earnings, and exceeding these limits may temporarily reduce your benefits.

Myth: Social Security Is Only for Retirees

Another widespread misconception is that social security is only for people who are retired. In reality, social security provides benefits for various situations, including disability benefits for those unable to work and survivor benefits for families of deceased workers.

Myth: Social Security Will Not Be There for Me

Some people worry that social security will not be available when they retire. While there are challenges facing the program, the government is committed to ensuring that benefits continue. Planning for retirement should include social security, but also consider other savings and investment options.

Myth: You Must Be Completely Disabled to Receive Benefits

Many think that if they have any ability to work, they do not qualify for disability benefits. This is incorrect. Social Security has specific criteria, and you may qualify even if you can work part-time or have limitations.

Understanding these myths is essential for navigating your options with social security benefits. Clear information can help demystify the process and ensure you can make decisions that best suit your needs.

Understanding social security benefits is essential for making informed decisions about your financial future. By recognizing the various types of benefits, eligibility requirements, and common misconceptions, you can navigate the system more effectively. Remember to gather all necessary information when applying and stay aware of your options, ensuring you maximize the support available to you. The more you know, the better prepared you’ll be to take advantage of the assistance provided by social security.

FAQ – Common Questions About Social Security Benefits

What types of social security benefits are available?

Social security offers various benefits, including retirement, disability, and survivor benefits.

How do I know if I am eligible for social security?

Eligibility typically depends on your work history, age, and the specific type of benefits you are applying for.

Can I work while receiving social security benefits?

Yes, you can work while receiving benefits, but there are earnings limits that may impact your benefit amount.

What is the application process for social security benefits?

You can apply online or in person, and it’s important to have all necessary documents ready before applying.